Promise & Growth of APIs

API or application programming interface empowers companies to open the data and functionality of their applications to external third-party developers, business partners, and other vital internal departments. This allows services and products to communicate with and use each other’s data and functions via a documented interface. Several industries, such as the payments industry, have used APIs for a while.

2021 was a big year for APIs, with Gartner’s research indicating that by 2024, the design mantra for most SaaS and custom applications will be API-first or API only. A recent survey conducted by Google highlighted the following benefits of APIs to business:

The growing breadth and impact of use cases for APIs have developed it into both a business strategy and technical strategy topic. Strategy teams have launched dedicated API research efforts and incorporated APIs into their digital strategies. Companies that do not prioritize APIs in their business strategies miss out on easily integrating and connecting people, systems, data, and algorithms to create new experiences, products, services, and business models. Bottom line, APIs are essential to accelerating transformation no matter what industry you’re in.

APIs in Banking & Financial Services

The two fastest-growing API categories globally are data and financial services. APIs play a critical role in financial services and are the backbone for several strategic shifts – Open Banking, Digital Transformation, Banking as a Service (BaaS), Fintech, etc.

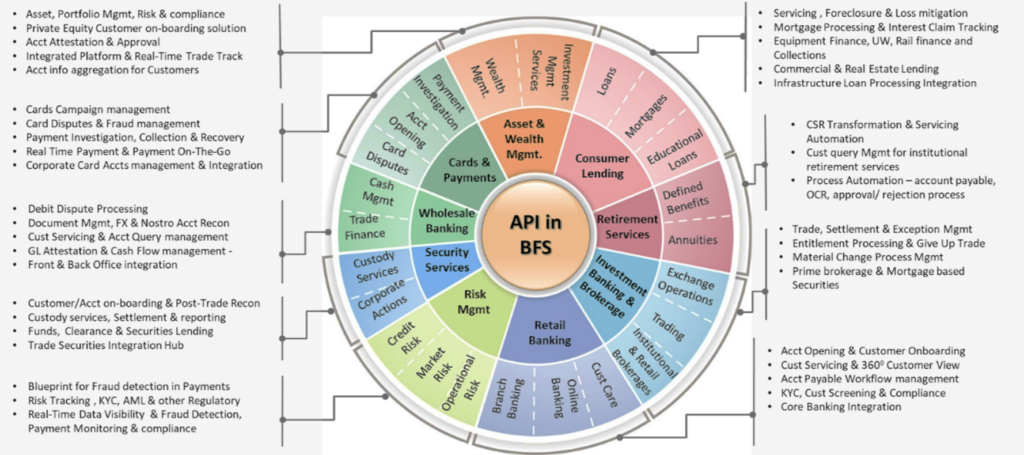

The diagram below provides potential API use cases in the core banking ecosystem:

Source: MindTree

Our research indicates five key areas where APIs are making an impact in banking & financial services:

Our research indicates five key areas where APIs are making an impact in banking & financial services:

API Monetization and Innovation:

Open Banking APIs expose a range of data to third-party financial service providers including payment initiators, account aggregators, and other emerging fintech. Open banking, embedded finance, and the cloud are changing how banks interact with their customers and the way they offer solutions. It also creates new ways of generating income. Goldman Sachs suggests that this trend will continue to accelerate over the next few years. The recent partnership between Goldman Sachs and AWS signals that financial firms are preparing for a future where their technology infrastructure will be as critical as the core services & solutions they offer.

Use Case Focus: The collaboration between Goldman Sachs and AWS offers new data, analytics, and banking solutions to its customers that create innovation and monetization opportunities. The collaboration significantly reduces the need for investment firms to develop and maintain foundational data-integration technology and lower the barriers to entry for accessing advanced quantitative analytics across global markets. Read more here.

Business Growth & Customer Experience:

Digital transformation has been a business imperative for a while in financial services, but Covid has expedited it. Digital transformation depends on a company’s ability to bundle its services, competencies, and assets in modular software components that can be used repeatedly. In the case of banks, they can help create new ecosystems of products and services while simultaneously enabling these ecosystems to be interconnected. While financial institutions are already beginning to take advantage of API strategies in commercial, wealth, and investment banking, McKinsey’s assessment is that this is likely to accelerate over the next few years. The next decade of customer growth could depend on leveraging technology to penetrate new ecosystems, many of which may lie outside traditional geographic footprints.

Use Case Focus: Citibank’s CitiConnect solution offers over 83 APIs for both data-driven services and transactions enabling clients to directly access products and services for a seamless and real-time banking experience. These APIs allow Citi to deliver a superior customer experience and highly automated solutions to its corporate customers. Citibank recently announced that their CitiConnect API connectivity platform reached a new milestone processing more than 1 billion API calls since its launch in 2017. Read more here.

New Data & Insights:

Banks collect data about their customers’ behavior and analyze it to identify marketing opportunities and conduct risk assessments. However, data siloes, and extensive business analytics prove this to be very challenging and ineffective. A recent survey by MuleSoft found that 94% of financial firms are still challenged by data silos, face issues with ingesting and aggregating new data, integrating ML, etc. Data analytics and delivery to businesses are mission-critical to financial firms as data is a crucial differentiator in a highly competitive environment. With APIs & Cloud, banks can now connect data and develop insights faster, and at scale without developing everything in-house. For example, Microsoft provides a text analytics API that can be used to perform various text analytics tasks such as language recognition, key phrase extraction, and sentiment analysis.

Use Case Focus: Bloom AI helped a financial data provider develop automated insights in 20,000+ monthly sales-customer interactions recorded in Salesforce. In less than 4 weeks, Bloom AI leveraged Salesforce API and Google NLP APIs to develop visual insights and alerting capabilities for product management and customer success teams. Read more here.

Next Level Productivity:

APIs improve overall connectivity and collaboration. In the early 1990s, an average company used a meager 5 to 10 applications. It is estimated that the average company now runs around 800 apps. APIs act as the glue allowing these otherwise separate software solutions – such as those for customer relationship management (CRM), marketing automation, and financial systems – to adhere to one another and seamlessly interact. In banking, up to 90% of APIs are currently designed for internal use. Use cases range from improving operational efficiency, reducing costs, improving security, and IT urbanization.

Use Case Focus: Refinitiv shows how API-first will be the future of data delivery and will help unlock the next level of operational efficiency. For example, the slow process of customer onboarding and managing financial crime in banking has been expedited through screening APIs that seamlessly perform checks against millions of risk records in one click. Read more here.

Finance for Good:

Financial institutions will play a key role in shaping the next generation of financial literacy and sustainability. With APIs, financial institutions will be able to extend open APIs and learning support on finance, investing, and related financial issues to people & institutions in need. Climate change, sustainability, and youth learning are immensely important topics and APIs can unlock several ways for financial firms to contribute to these important topics.

Use Case Focus: Investec has worked in partnership with Arrival Education since 2015 to teach high school students about the ins and outs of portfolio management, global markets, and long-term investing. To save time from manually logging the business numbers and manually updating portfolios, Investec partnered with FactSet to develop a portfolio that uses FactSet’s API connections for model portfolios and portfolio analyses. With API and the direct provision of global data to students in an easily accessible portal, Investec reduced the time it takes to organize information. Read more here.

About Bloom AI

Bloom AI (https://bloomai.co/) is a Data Delivery Platform that reimagines how business users access and experience data for faster, more informed decisions every day. Built on an insights-as-a-service (IAAS) infrastructure, Bloom AI product & solutions focus on speed, context, and personalization of your most valuable data use cases, without overwhelming you with tools or technology.

Bloom AI is on a mission to help clients harness the full potential of data & information to drive business growth, creativity, and sustainability. Our focus is on solving the last mile data & insights in financial services & other industries.